Funding for Care: How Short-Term Funding Supported a Care Home’s Continuity and Growth

Company Sector: Care Homes

Loan Amount: £180,000

Loan Purpose: Working Capital & Cash Flow Management

The Challenge

When we first engaged with one of the UK’s most established care home providers, the business was experiencing short-term cash flow pressures alongside the need to settle existing debts. Extended payment terms on client contracts created further strain on working capital, leaving supplier payments and day-to-day operations under pressure.

For a care provider built on delivering consistent, personalised services across both residential care homes and home care services, any disruption to financial stability risked affecting its ability to support staff across all facilities and maintain the high standards of service that clients rely on.

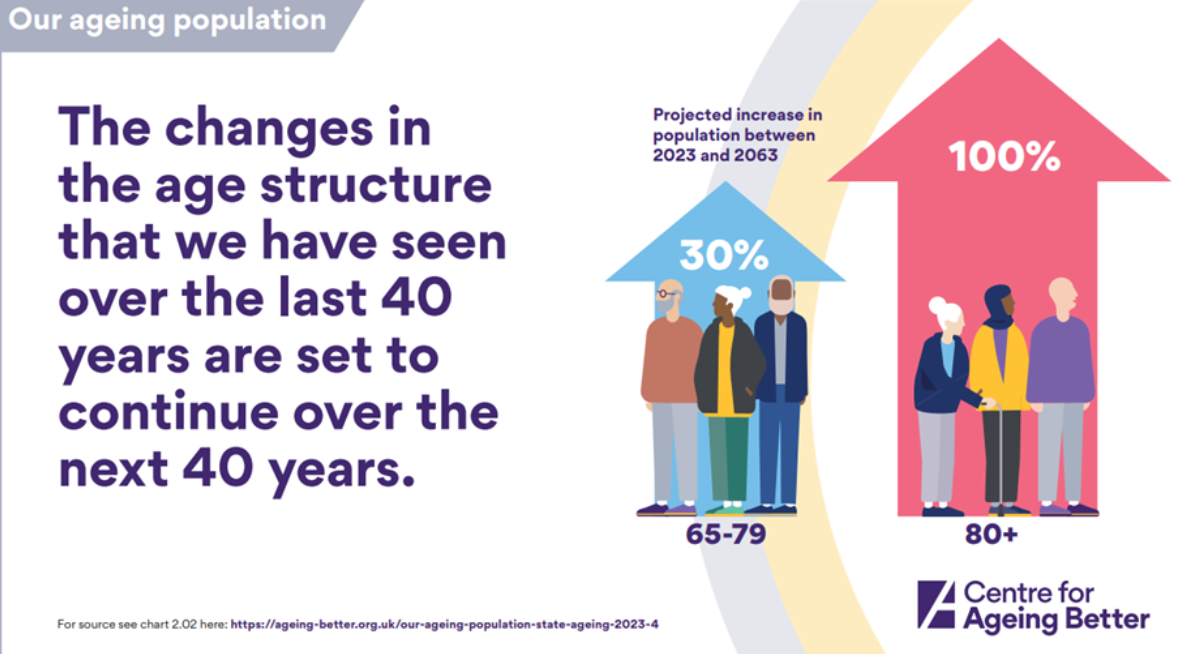

This challenge is not unique and demand for care homes continues to rise. According to the Centre For Ageing Better’s ‘State of Ageing Report’: “The number of people aged 65-79 is predicted to increase by nearly a third (30%) to over 10 million in the next 40 years, while the number of people aged 80 and over – the fastest growing segment of the population – is set to more than double to over 6 million.”

With pressures on funding and recruitment across the sector, financial resilience is vital for care businesses that need to balance operational stability with increasing demand.

Our Solution

We arranged a short-term funding facility of £180,000 to act as a solution over a 3–6 month period. This was structured to:

- Stabilise immediate cash flow and ensure payroll and supplier commitments could be met.

- Consolidate short-term debts, providing breathing space for the management team.

- Allow the business to focus on its operational priorities, maintaining continuity of care across both care homes and home care services while supporting its workforce and repositioning for longer-term stability.

The Results

With funding secured, the company was able to:

- Relieve immediate financial pressures and restore operational stability.

- Maintain relationships with staff and suppliers, protecting reputation.

- Continue delivering high-quality care without disruption to clients.

The funding enabled the business to avoid short-term challenges escalating into longer-term issues. Instead, it positioned itself to consolidate debts, return to a sustainable operation and focus on providing high-quality care to their clients.

If you're facing similar challenges and want to explore the options available, get in touch 01832 770 273

Bright

Bright in our thinking - we challenge convention to find smarter solutions

Efficient

Efficient in our approach -

our expertise allows us to deliver faster

Accurate

Accurate in our process - we expertly match to enhance approvals

Relentless

Relentless in our drive - we're committed to helping your business grow